The post The Benefits of Retail Media for Retailers and Advertisers appeared first on Clearcode.

]]>With a staggering $45 billion US retail media market, retailers are attempting to seize the golden opportunity that retail media presents to not only cater to evolving consumer preferences, but also open up new avenues for advertisers seeking to engage with their most coveted audiences.

In this blog post, you will learn about the opportunities for retailers and advertisers in the retail media space, as well as the challenges related to using AdTech within the retail landscape.

Key Points

- Retail media networks (RMNs) are capturing a growing portion of marketing budgets as manufacturers and brands redirect their expenditures to focus on engaging consumers in proximity to the point of purchase.

- The end of third-party cookies in web browsers and the focus on using first-party data for advertising is a key force that’s driving interest in retail media.

- Between 2024 and 2027, retail media is expected to be the fastest-growing advertising channel.

- The main benefits of retail media for advertisers are closer relationships with their consumers, more accurate targeting, and closed-loop attribution.

- The main benefits of retail media for retailers are the ability to unlock and monetize their first-party data, improve inventory management and sales, and boost company revenue.

- The main challenge for retailers when building a retail media network is finding a software development partner that has experience in AdTech development.

The Rise of Retail Media

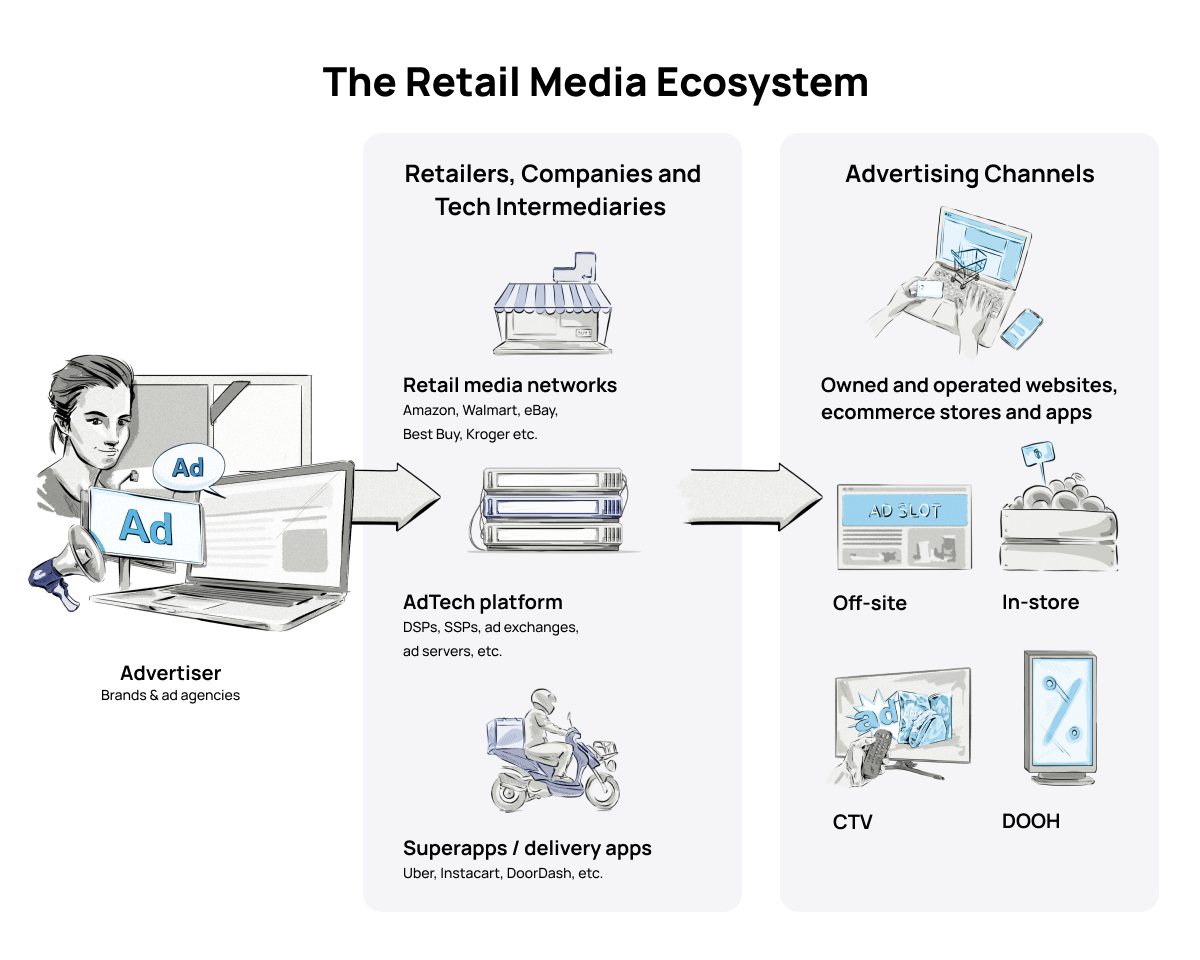

While both retail and retail media share the common goal of driving sales and enhancing the customer experience, they operate on distinct fronts within the retail ecosystem, so it’s crucial to differentiate them.

Retail, in its classic form, encompasses the brick-and-mortar stores and e-commerce platforms where products and services are sold directly to customers.

Retail media, on the other hand, is a relatively new phenomenon that has roots in traditional retail advertising but has evolved to adapt to the digital age; it represents a convergence of commerce and advertising within the retail space.

There are various reasons for retail media’s rise in popularity among advertisers and retailers, one of which is the desire to reach consumers just as they’re about to buy a product.

The end of third-party cookies in web browsers and the focus on using first-party data for advertising is another key force that’s driving interest in retail media.

Yet another key aspect is the fact that the demand for shopper convenience has become one of the top priorities, accelerated even more by the transformative impacts of the pandemic and continuous technological advancements.

This leaves retailers with no choice but to accommodate consumers’ needs by improving the overall shopper experience, whether it’s through a smoother shopping process or by providing personalized but non-intrusive ads.

Moreover, in a recent survey by Prosper Insights & Analytics, around 19% of consumers expressed a preference for the convenience of purchasing online and utilizing in-store pick-up services, while 18% used grocery delivery apps, and 16% made regular online purchases for home delivery, making it crucial for retailers to boost their social media presence either through paid advertising or social media marketing, which will simultaneously generate traffic in their physical stores.

It’s also worth mentioning that from 2024 onwards, and at least until 2027, retail media is expected to undergo an exceptional upswing, meaning that establishing a fresh retail media partnership model that brings retailers, advertisers, and AdTech together will be crucial.

The Benefits of Retail Media for Advertisers and Retailers

As the digital advertising landscape continues to evolve, retail media is poised to play a pivotal role in the success of both advertisers and retailers, as it represents a win-win situation for both groups.

In short, advertisers can gain access to highly targeted audiences, improve their ROI, and obtain valuable insights, while retailers can enjoy a new revenue stream, enhanced customer experiences, and a competitive edge in the market.

However, let’s explore a bit further to see what advertisers and retailers can actually gain by including retail media as part of their business strategy.

For Advertisers

Being Closer to Consumers

In order to reach consumers right on the verge of purchasing the product, manufacturers and brands are increasingly redirecting their investments, mainly into RMNs.

According to research done by McKinsey, 73% of advertisers expect to boost their spending on RMNs in the next 12 months, and RMNs are anticipated to account for roughly 10-15% of the complete media expenditure.

Targeting Shoppers Accurately

RMNs employ sophisticated data analytics to identify and reach ideal shoppers. By tapping into first-party shopper data, advertisers can gain invaluable insights into consumer preferences, behaviors, and needs, ensuring that customers are exposed to products that genuinely resonate with their interests.

Implementing Closed-Loop Attribution

With ad impressions and sales occurring within the same platform, advertisers can precisely monitor the effectiveness of their advertisements and, therefore, readily demonstrate that their marketing efforts are delivering tangible results.

Thanks to closed-loop attribution, the influential marketing channels are automatically credited, making it easier for advertisers to understand the customer journey and to determine which of their ads contributed to a conversion.

We Can Help You Build a Retail Media Network (RMN)

Our AdTech development teams can work with you to design, build, and maintain a custom-built retail media network (RMN) for any programmatic advertising channel.

For Retailers

Unlocking First-Party Data

In the world of retail media, Amazon and Walmart significantly dominate the industry due to their large amounts of first-party consumer data.

However, across the entire retail media ecosystem, numerous independent AdTech companies exist to help retailers unlock the value of their first-party data to power audience targeting, measurement, and attribution.

Improving Inventory Management and Sales

AdTech can help with better inventory management since it can provide product information and highlight product availability at specific stores.

This can help retailers promote the products they have in stock and avoid promoting those products that are out of stock, leading to better inventory management and an increase in sales.

Boosting Revenue

It’s not always possible for retailers to increase the margins on their products, but by building an advertising business, they can create a new revenue stream.

By establishing an advertising business that’s centered around their first-party customer data, retailers can create a new revenue stream that will allow them to offset revenue from low-margin or fixed-margin products sales.

The Main Challenges Retailers Face When Building a Retail Media Network (RMN)

Despite the rise in popularity and investment, the retail media industry is facing growing pains. While most of these issues are business related, some are connected with the technological side of building and running a retail media network.

Balancing Ambition with Pragmatism

While the potential for any retailer with a receptive audience to establish an RMN exists in theory, the practical execution of such networks demands a substantial investment of both time and financial resources.

As marketers venture into the world of retail media, they are confronted with the intricate challenge of managing media purchases across numerous networks. The endeavor, although promising in terms of reach, often proves to be costly and time-intensive.

Retailers that decide to go down the build-it-yourself path quickly realize that developing an AdTech platform to power their retail media business is not an easy task, even for seasoned developers.

Without support and input from an experienced AdTech development partner, retailers will likely experience delays in launching their retail media network.

Navigating Uncharted Territories

Even with the potential of closed-loop attribution, the absence of standardized measurement practices is a prevalent concern, making it difficult for advertisers to measure ad campaigns.

This lack of universally accepted metrics and methodologies also hinders effective assessment and comparison across campaigns and platforms.

It’s a challenge that retailers face when building a retail media network, but that’s not to say that it can’t be achieved with the right technology and first-party data strategy.

Also, it’s likely that industry bodies like the IAB will introduce measurement standards for retail media in the future, just as has been done for other digital advertising channels.

Shifting From Expansion to Consolidation

As the retail sector witnesses a gold rush of retailers vying to establish their RMNs, the industry will soon find itself with a fragmented landscape that includes hundreds of RMNs for brands to choose from.

Smaller retailers at the fringes of this expansion may face a natural process of consolidation and be acquired by larger players.

For retailers, the influx of competitors necessitates a strategic approach that encompasses innovation, value proposition differentiation, and a keen awareness of the evolving market dynamics.

For this reason, it’s vital that retailers get the technology part right — both the internal and external integrations, as well as the technical consultancy and development aspects — when building their RMNs.

Doing so will help them to fully utilize their first-party data.

Maintaining Exclusivity and Attraction

The allure of cultivating a walled garden approach, while fostering exclusivity, comes with the inherent risk of alienating potential advertisers.

Striking a balance between creating an enticing environment for advertisers and upholding the principle of openness is an ongoing challenge for RMNs, but it can be achieved with the right business strategy and development partner.

We Can Help You Build a Retail Media Network (RMN)

Our AdTech development teams can work with you to design, build, and maintain a custom-built retail media network (RMN) for any programmatic advertising channel.

The post The Benefits of Retail Media for Retailers and Advertisers appeared first on Clearcode.

]]>The post What Is In-App Mobile Advertising and How Does It Work? appeared first on Clearcode.

]]>Fast forward to 2023, when 1.96 million apps are available on the App Store and consumers are predicted to spend $33.9 billion in app stores.

Moreover, as many as 86% of people use other devices while watching TV, with between 68%-76% of viewers using a smartphone to research information, use social media, and reply to messages.

Taking all that into consideration, in-app mobile advertising presents a great opportunity for advertisers. With many of us being so dependent on mobile devices, using mobile advertising to reach a target audience is a no-brainer for marketers and advertisers.

In this article, you will learn about mobile advertising, how it’s different from in-app advertising, and how in-app advertising works

Key Points

- In-app (aka, mobile app) advertising refers to displaying ads within mobile apps on smartphones and tablets.

- Mobile apps serve ads through the use of a software-development kit (SDK), meaning that developers have to integrate the given AdTech vendor’s SDK into their app.

- Gaming, social, utility, and entertainment companies rely heavily on in-app advertising (IAA) to generate revenue.

- As app developers get paid to serve advertisements within their mobile app, in-app advertising allows publishers to keep their content free for users, boosting downloads while earning scalable revenue.

- Nowadays, the app economy is dominated by free-to-download apps, with only a small portion (~5%) of users making in-app purchases (IAP) and generating revenue for apps.

- According to data.ai’s research, time spent on Android phones per day has reached 5 hours in the top mobile-first markets, along with the number of app downloads hitting 255 billion in 2022, with global consumers downloading more than 485,000 apps per minute.

- The main types of in-app ad formats include playable ads, interstitial ads, offerwalls, rewarded video ads, video ads, expandable ads, standard banner ads, and native ads.

The Growth of Mobile Advertising

These are just some of the events that have shaped mobile advertising into what it is today:

- Although the handheld mobile phone was developed in 1973, it wasn’t until 1992 that the first text message was sent.

- It was only in 1997 that free news headlines via short message service (SMS) were offered by a Finnish news provider.

- The first phone used for email was released in 1999.

- Mobile marketing came to life in 2000 when the Wireless Advertising Association in New York and the Wireless Marketing Association in London were created around the same time; together, they transformed into the Mobile Marketing Association in 2003.

- 2006 brought AdMob, the first leading mobile advertising platform, thus giving web developers and publishers the possibility to monetize mobile ads.

- Introduced to the public in 2007, Google’s Mobile AdSense allowed websites optimized for mobile browsers to display the same ads as a regular website.

- Before AdSense was released, the launch date of the first iPhone was announced in early 2007.

- iPad went on sale in 2010, and a few days afterwards, Apple introduced their advertising platform, iAD.

- Facebook’s Mobile Ads was launched in 2012. Prior to this launch, Facebook garnered no revenue from the mobile app because no advertising was available.

The release of the first iPhone in 2007 totally changed the game for mobile advertising, giving users the option to interact with a mobile ad in a new way: the touch-sensitive, multi-sensor interface enabled ads to to be shrunken or enlarged, as well as rotated.

Considering that people use apps for all sorts of things, it’s not surprising that time spent “in-app” keeps increasing year-on-year (YOY).

However, users tend to spend more time in-app compared to on the mobile web these days, so although marketers and advertisers have more hours and ways to reach them each day, they have to think of innovative ways to actually catch the attention of their target audience.

Evidence of this behavior is illustrated in the following statistics from Data.ai’s State of Mobile 2022 report:

- Time spent on Android phones per day has increased to 5 hours in the top mobile-first markets.

- App downloads reached 255 billion in 2022, with global consumers downloading more than 485,000 apps per minute.

- Mobile ad spend is predicted to get as high as $362 billion in 2023, despite tightening marketing budgets.

- What’s concerning is that the App Store spend has cooled to $167 billion (-2% YoY) due to a decline in gaming spend, which was previously bolstered by pandemic conditions.

We Can Help You Build an AdTech Platform

Our AdTech development teams can work with you to design, build, and maintain a custom-built AdTech platform for any programmatic advertising channel.

What Is In-App Advertising?

In-app advertising, aka mobile-app advertising, refers to displaying ads within mobile apps on smartphones and tablets. Brands and advertisers run ad campaigns across multiple mobile apps to increase brand awareness and conversions, just like they do with other digital advertising channels, such as web advertising.

Gaming, social, utility, and entertainment companies are quite dependent on in-app advertising (IAA).

Since app developers get paid to serve advertisements within their mobile app, publishers can keep their content free for users.

Not only does this model keep content free, but it also drives the number of downloads up, as well as providing scalable revenue for app developers and publishers.

Currently, it’s rather rare for apps to require payment up front, as most have a freemium model that lets you download the software for free with the option to upgrade later in order to be able to use more features, remove ads, have access to more content, or buy stuff.

Moreover, only a small portion (~5%) of users decide to make in-app purchases (IAP) and, therefore, generate revenue.

There are apps that are capable of relying on IAP alone, but most of them prefer to use ad revenue from in-app advertising (IAA) as their main revenue stream.

Now that we’ve got the definition of in-app advertising out of the way, let’s move on to how in-app ads work.

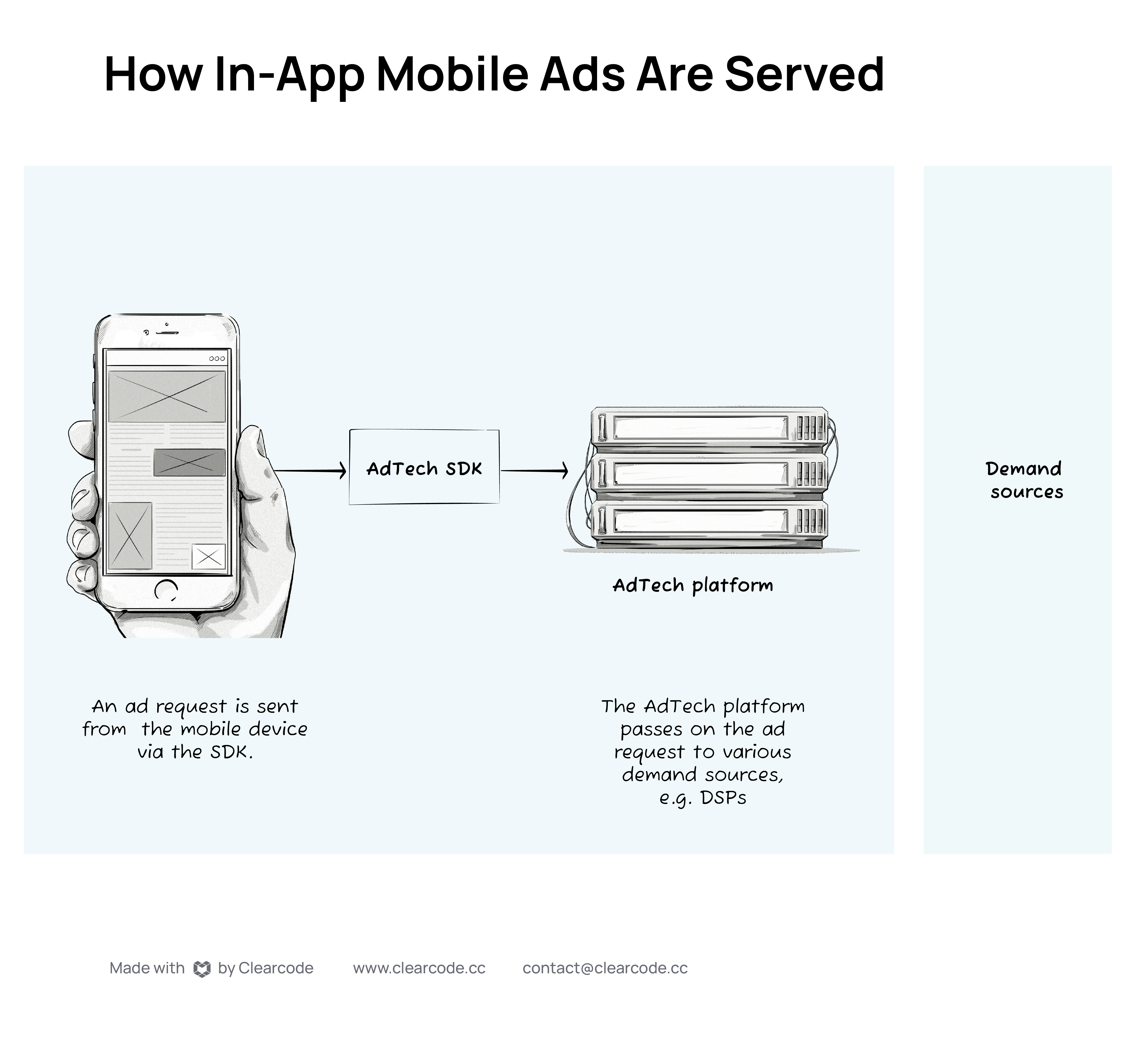

How Are In-App Ads Served?

Mobile apps need to use a software-development kit (SDK) in order to display ads, meaning that developers have to integrate the given AdTech vendor’s SDK into their app. In terms of how ads are shown, it’s done through an AdTech platform, such as a mobile ad network.

An ad network is a platform that brings developers and advertisers together.

Due to constant changes in formats, programmatic ad buying, and real-time bidding, developers are now able to automate and handle ads more efficiently than in the past.

In addition, ads have undergone advancements to enhance intuitiveness and seamless integration within the mobile user experience.

Like all the other digital advertising channels, the in-app mobile advertising ecosystem is divided into the buy side and the sell side, with various advertising technology (AdTech) platforms playing a key role in the delivery and measurement of in-app ads.

The buy side consists of stakeholders buying the ads. These are app developers and agencies who are responsible for designing mobile ads, coming up with a campaign strategy, and then launching the ad campaign.

The sell side, on the other hand, is made of apps selling ad space, known as publishers, with app publishers (developers) combining a mediation platform with various ad networks through a software development kit (SDK).

An ad network acts as a broker, meaning that it takes care of selling the publishers’ in-app inventory to the advertisers, along with handling the process of matching a publisher’s ad supply with the advertiser’s demand.

Apart from the ad network, we’ve also got the ad exchange.

An ad exchange resembles a stock exchange, so instead of simply selling impressions by the thousand, the ad exchange lets advertisers select their desired audience and bid on individual impressions.

Two other key AdTech platforms are the demand-side platform (DSP) and the supply-side platform (SSP).

The former gives advertisers access to inventory from numerous ad exchanges, while the latter lets publishers manage their in-app ad inventory and make it available to advertisers via an ad exchange and DSP.

So, how does the whole system work exactly?

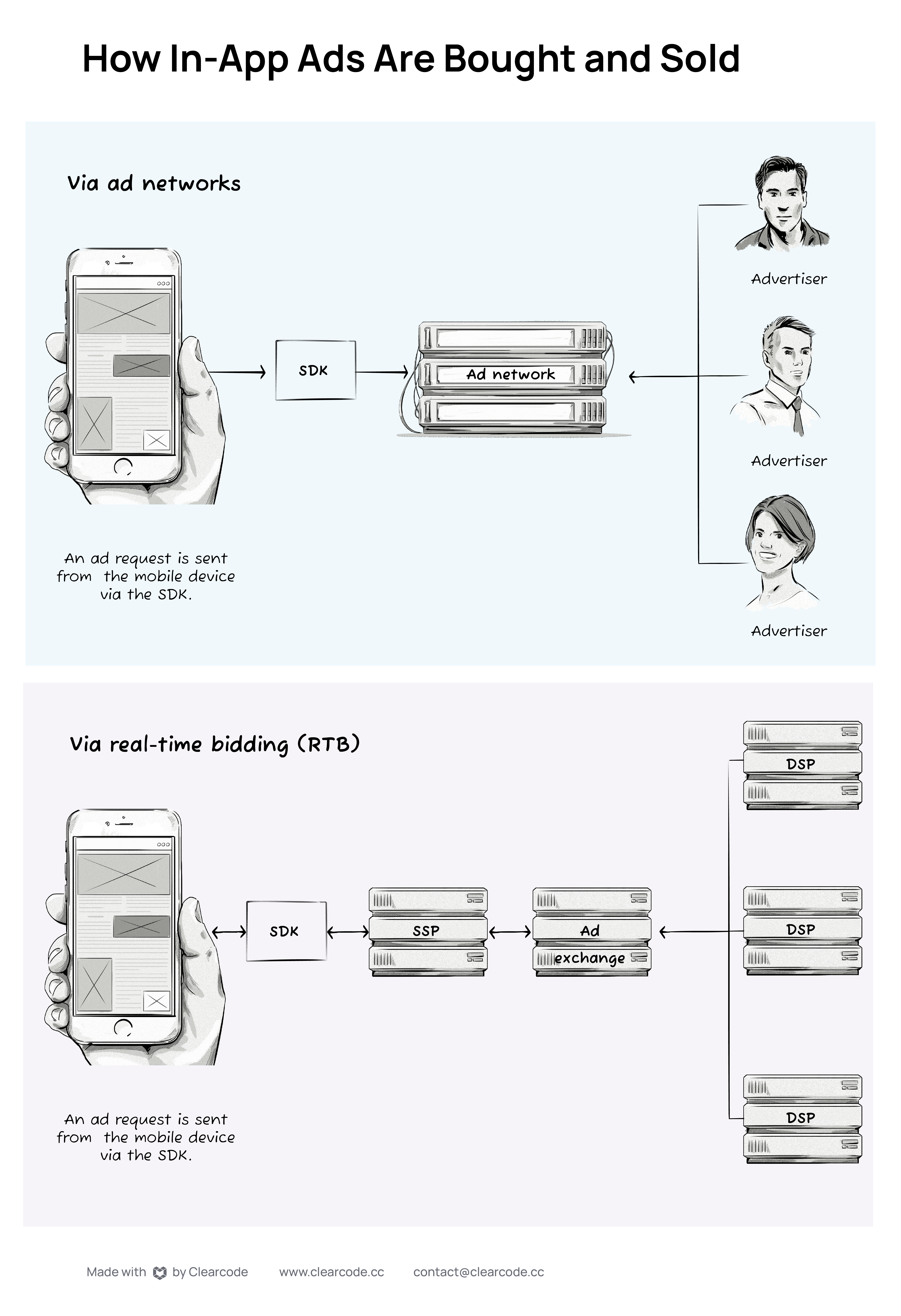

Well, it depends on how the in-app mobile ads are bought and sold.

If an ad is being transacted via an ad network, then an ad request will be sent from the mobile app to an ad network via an SDK. The ad request will be matched with an advertiser’s campaign, and an ad will be selected. The ad will then be sent back to the mobile app and displayed to the user.

If the ad is being transacted via real-time bidding (RTB), then an ad request will be sent from the mobile app to an SSP via an SDK. The SSP will then pass on the ad request to an ad exchange, which will then pass on the bid request to multiple DSPs.

Each DSP will evaluate the bid request, match it with the advertisers’ ad campaigns, and send back a bid response. The ad exchange will then hold an auction where each of the bids from the various DSPs will compete against one another.

The highest bid will win the impression, and the ad will be shown to the user.

Below is an overview of how in-app mobile ads are bought and sold via ad networks and RTB.

What’s the Difference Between In-App Advertising and Mobile Advertising?

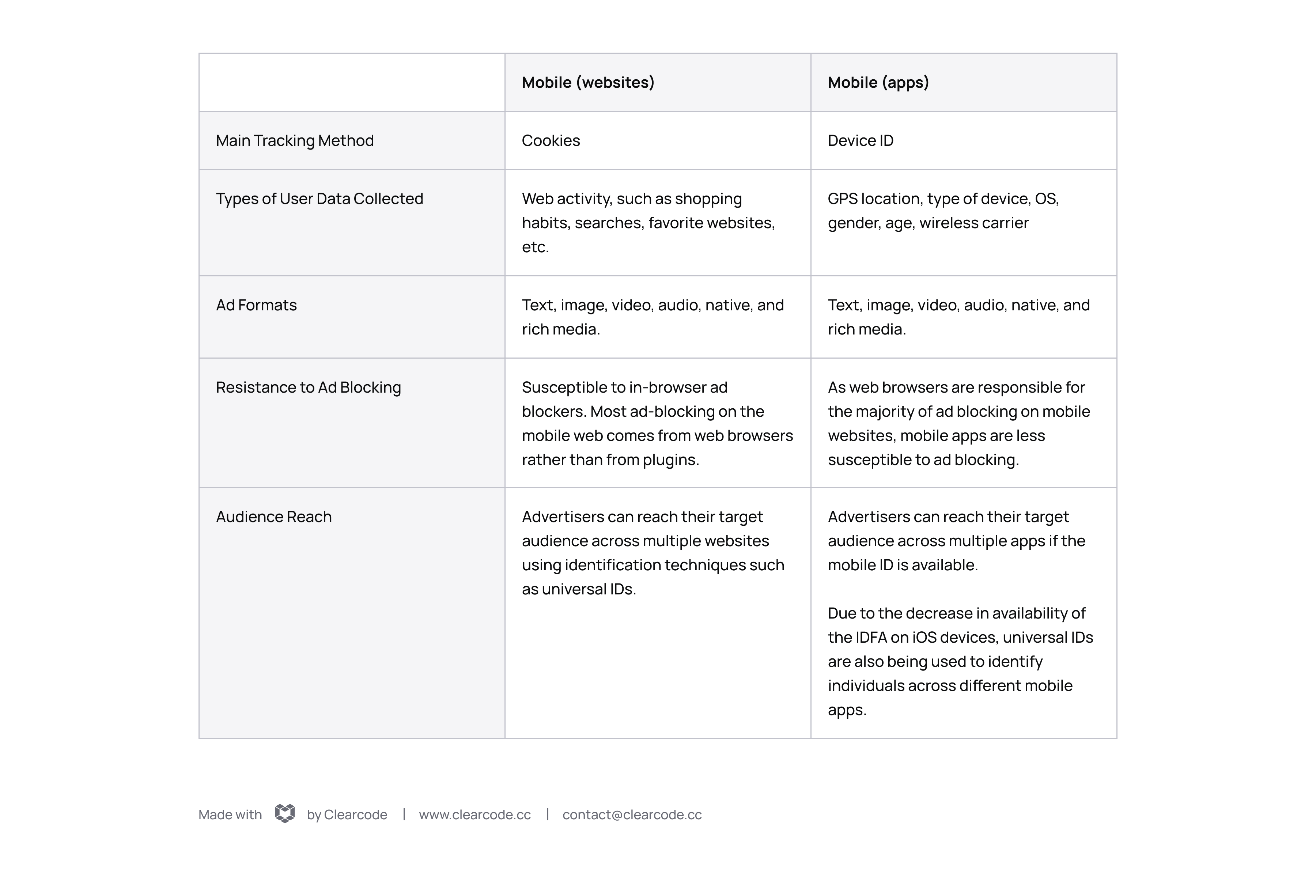

Here’s a short comparison between mobile and in-app advertising:

Now, let’s see exactly how these two types of advertising can be differentiated.

When it comes to mobile devices using a browser to display ads, they don’t require a software-development kit (SDK), as these ads are served in the same way as ads on websites.

Mobile apps, on the other hand, need the mobile app’s developers to integrate the given AdTech vendor’s SDK into their app so that the ad space where the ads will run is defined, along with information about the ad medium (e.g., text, image, native, and video) and the ad format (e.g., interstitial and banner).

Despite less time being spent on the mobile web compared to in-app activity, the mobile web offers more contextual- and audience-targeting opportunities, due to the fact that new web pages are being created all the time.

Thanks to that, advertisers are capable of reaching audiences based on their interests across the whole Internet, making the mobile web a huge opportunity for advertisers in terms of scale.

There’s also the matter of available formats.

Most ad formats adjust well to the mobile web — whether it’s native ads that seamlessly blend into their surrounding content, or video ads, which are a useful weapon for battling “banner blindness”.

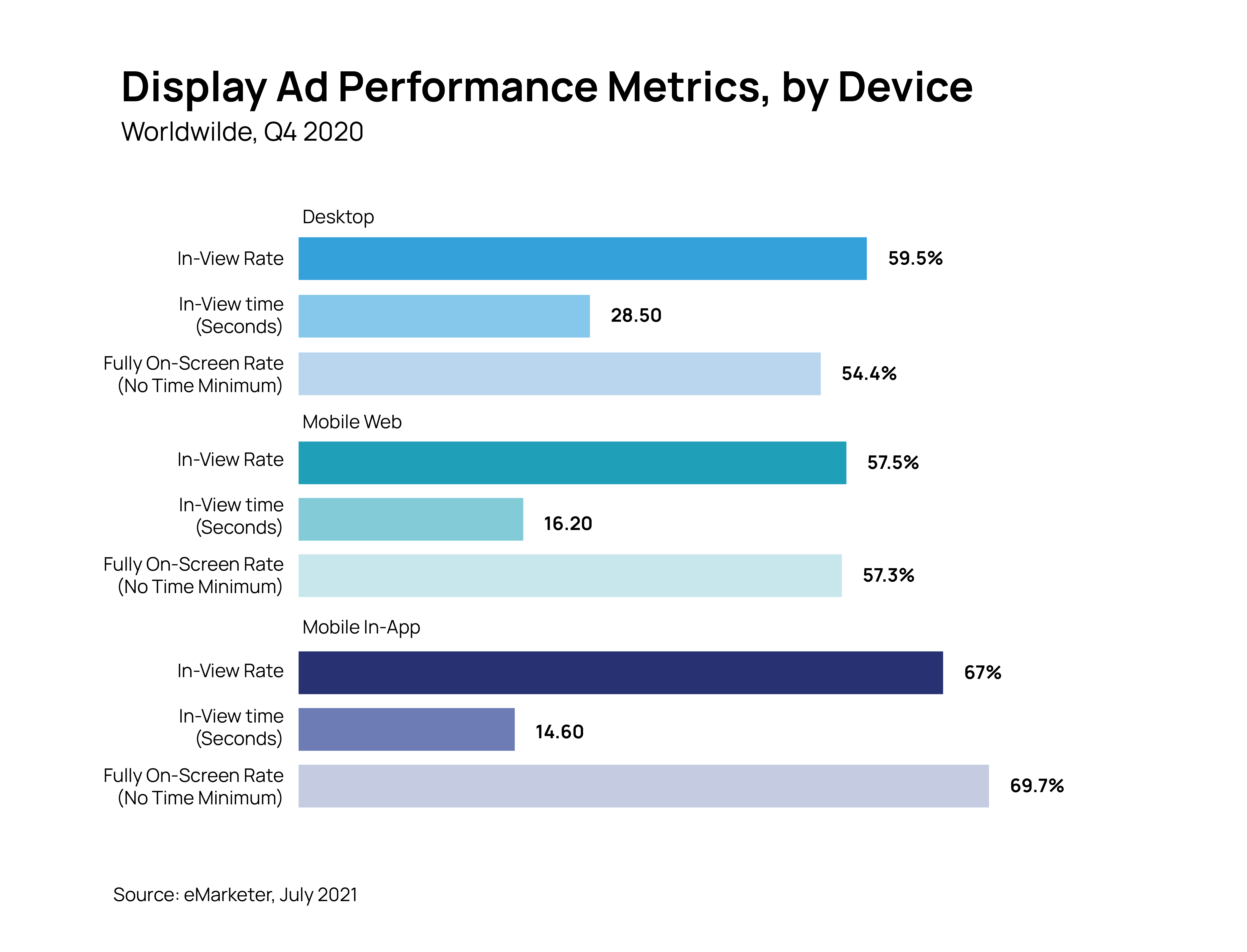

What’s also important to mention is viewability. Based on research from eMarketer, the global viewability rate is much higher in-app than for either the mobile web or desktop:

It’s all due to the fact that ads shown in apps are better at capturing one’s attention, as they are often more prominent and can’t be closed as easily as ads displayed in a browser.

It’s also worth pointing out that desktop and laptop computers might be shared, whereas mobile phones generally only have one owner, so installed apps have a thorough personal connection with the user and their daily habits, making the in-app environment a perfect space for creating effective and personal advertising touchpoints.

Examples of In-App Ad Formats

There’s no right or wrong answer as to which in-app ad format you should choose to get your desired results, but you can certainly find one that is suitable for your needs.

The best way to do this is by deciding what you’re aiming to achieve with your campaign.

Each type of in-app ad offers various useful benefits, so let’s explore them to know what they bring to the table.

Playable Ads

Playable ads are like app “samples,” as they allow users to try out the software through all sorts of mini-games before installing it.

Since these ads are interactive, they tend to be received positively by the audience, provide a good user experience, and deliver the highest eCPMs in the industry.

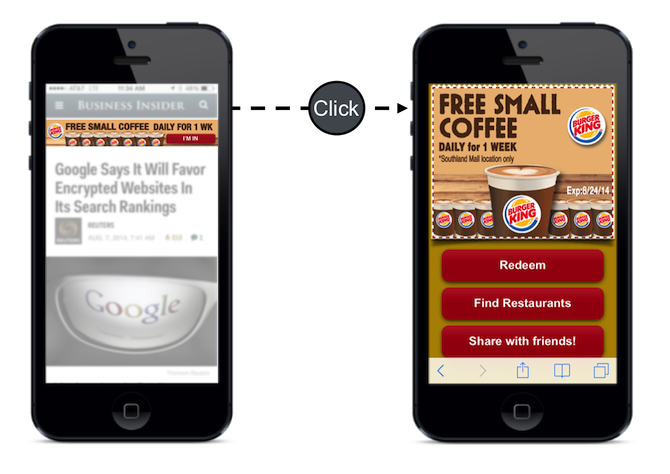

Interstitial Ads

Interstitial ads provide users with rich, customizable, and appealing static or in-app video ads at natural pauses in an app’s flow, such as when a user opens the app, browses between pages, or switches between games. This frequency of ad exposure keeps the disruption of the user experience to a bare minimum.

They do, however, require user action in order to be closed or display the desired content.

One of the most distinguishable interstitial ads is a splash ad, a full-screen interstitial ad shown when the app is opened but before any other content is loaded.

Offerwalls

Offerwalls are essentially mini-stores within the app.

They mainly present a list of tasks that users can do and in exchange for an in-app reward.

The user has to initiate this type of ad, which extends session length; hence, they hold a dominant position among eCPMs.

Rewarded Video Ads

With rewarded video ads, users receive various prizes for watching a video.

Not only are they displayed voluntarily, but they also boost in-app purchases and encourage users to come back.

Video Ads

In-app video ads last between 15 and 30 seconds.

Moreover, compared to desktop ads, users pay more attention to in-app video ads because, without the ability to multitask, their attention is solely directed toward the ad.

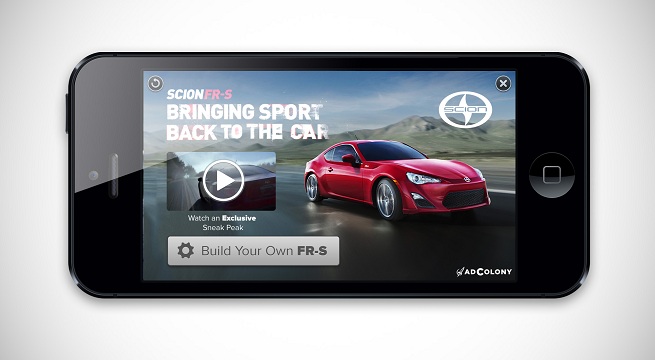

Expandable Ads

Although expandable ads are usually rich media ads, they are also considered a mix of banner and interstitial ads.

Starting with a teaser banner (320×50 pixels), they then expand to 320×480 pixels after being clicked on by the user. The enlarged version of the ad gives advertisers more space to deliver the message they are trying to convey in the ad.

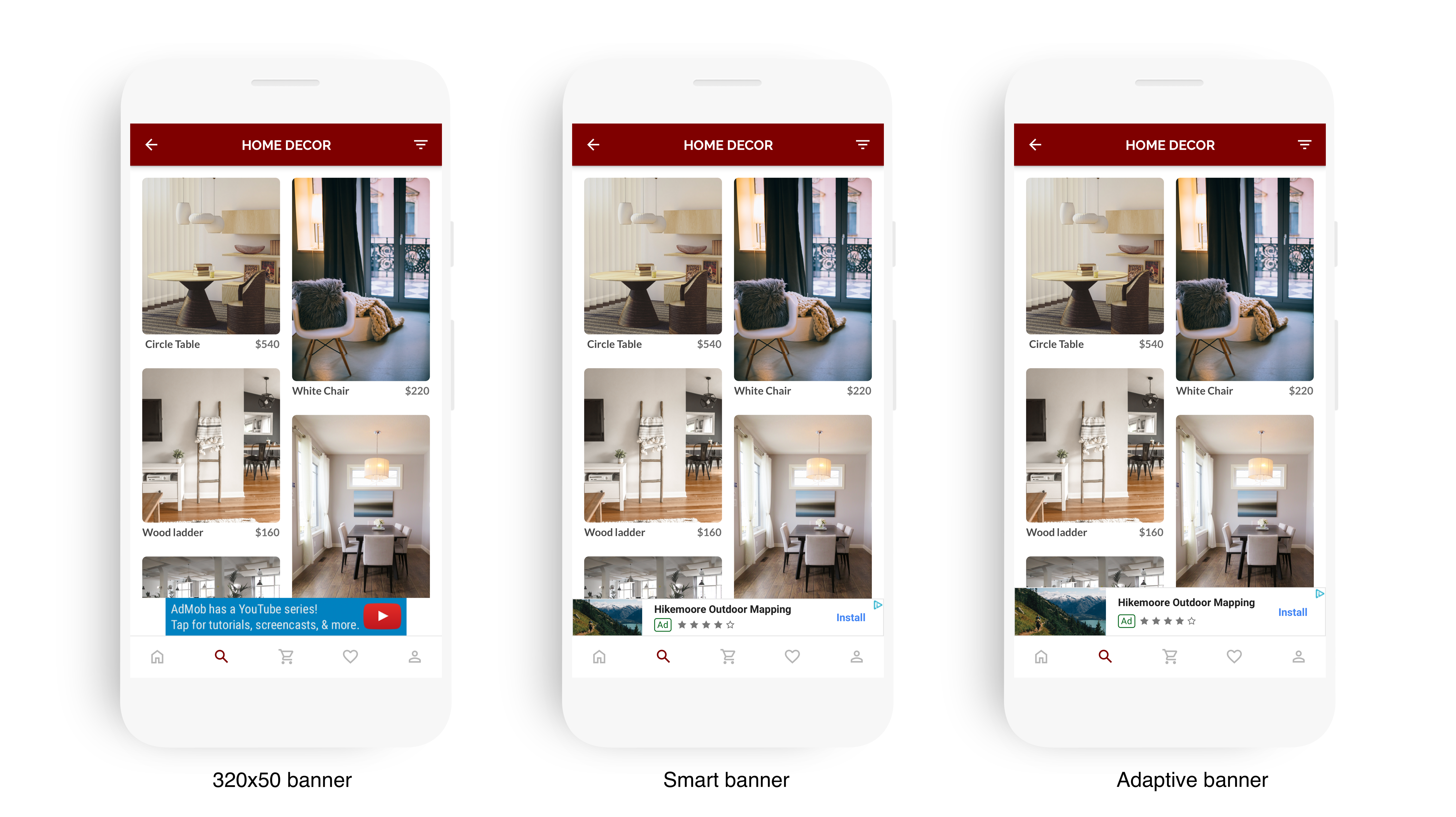

Standard Banner Ads

Standard banner ads vary from 320×50 to 300×50 pixels, and they’re usually static or animated. Moreover, they commonly appear at the top or bottom of the screen.

Despite being fairly simple, this is the most popular advertising format.

Back in the day, these ads weren’t quite effective, but if implemented in the right context, they’re passive and non-intrusive; thus, they contribute to user experience satisfaction.

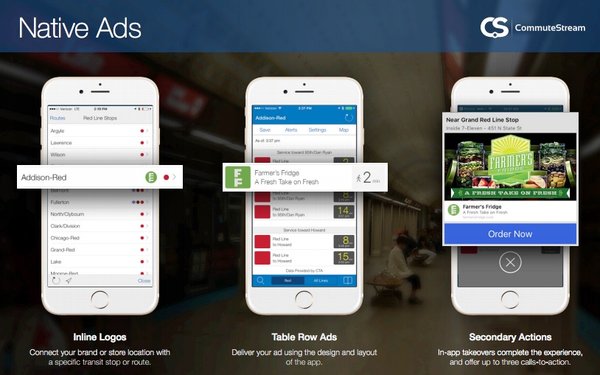

Native Ads

Overall, native ads combine advertising messages with user-centric content.

As publishers aren’t given an actual ad but rather the components of the ad, they’re the ones deciding how to display the element in ways that fit well with its app, meaning that there’s no one established standard in terms of form and size.

We Can Help You Build an AdTech Platform

Our AdTech development teams can work with you to design, build, and maintain a custom-built AdTech platform for any programmatic advertising channel.

The post What Is In-App Mobile Advertising and How Does It Work? appeared first on Clearcode.

]]>The post What’s the Difference Between CSAI and SSAI? appeared first on Clearcode.

]]>Despite this huge expansion, many popular streaming services are facing a plateau or decrease in paid subscribers, so new content and platform features are a way to both attract new customers, as well as offer something fresh and exciting to those who are already subscribed.

That’s why streaming platforms are looking for ways to introduce advertising into the equation by offering a cheaper ad-supported plan.

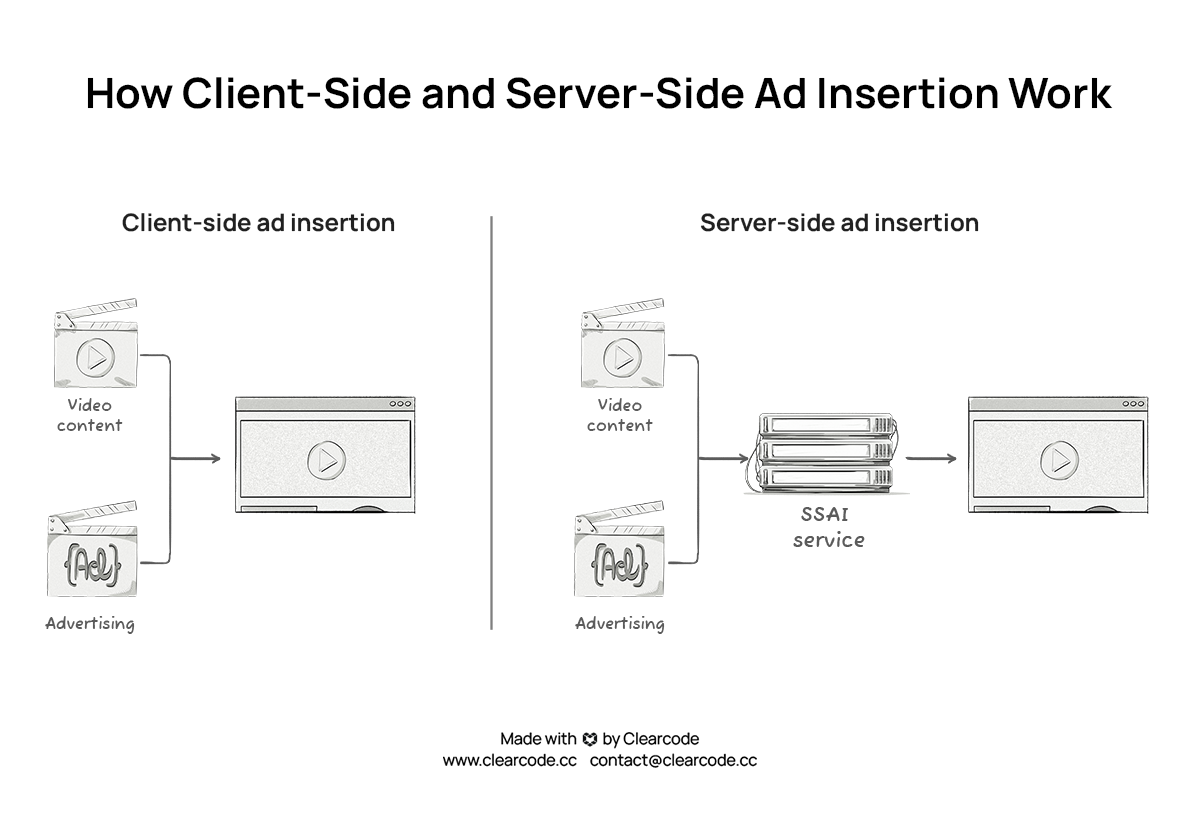

When it comes to the delivery of ads in the connected TV (CTV) and over-the-top (OTT) video environments, there are 2 ways through which they can be inserted into the content: client-side ad insertion (CSAI) and server-side ad insertion (SSAI).

In this article, you will learn how they work, what the difference between them is, and when it’s best to use each of them.

Key Points

- Client-side ad insertion (CSAI) is a video ad-serving method whereby the video player requests an ad from an ad server via the video player located inside an application or website.

- Client-side ad insertion offers many advantages, including the ability to support various kinds of ads, be it skippable, clickable, or closable; track metrics for ad performance reporting, and show personalized ads to individual users.

- Server-side ad insertion (SSAI) is a video ad-serving method whereby the ads are stitched directly into the video content on the server side instead of the client application or video player, as is the case with client-side ad insertion (CCAI).

- The main advantages of server-side ad insertion are that it’s less susceptible to ad blockers and provides a better user experience as there isn’t ad buffering when displaying the ads.

The Rise of Advertising in Video-Streaming Services

Video advertising has always been seen as a premium medium as it allows brands to show engaging video ads to their target audience and allows publishers to receive a higher CPM compared to display ads.

It has also provided users with more choice over how they consume video content.

For those viewers who are unwilling to pay for an ad-free plan, whether they were previously subscribed or not, can still enjoy the content on the streaming service for a lower price.

For streaming services, it allows them to attract new subscribers and potentially convert them to the higher paid subscriptions, as well as generate additional revenue via advertising.

The primary revenue sources for streaming services are as follows:

- Subscription video on demand (SVOD) where the consumer pays a recurring fee to watch ad-free content.

- Ad-supported subscription is when the viewer can watch content for a fee with ads being shown at various times, e.g. before the content starts. The subscription fee to watch ad-supported content is cheaper than the ad-free subscription fee.

- Transactional video on demand (TVOD) is based on the pay-per-view model and can be further divided into electronic sell-through (EST), where you pay once to gain permanent access to a piece of content, and download to rent (DTR), where customers access a piece of content for a limited time for a smaller fee.

- Advertising video on demand (AVOD) is where the consumer can watch content containing ads without any fee.

We Can Help You Build a Connected TV (CTV) Ad Platform

Our AdTech development teams can work with you to design, build, and maintain a custom-built connected TV (CTV) ad platform for any programmatic advertising channel.

What Is Client-Side Ad Insertion (CSAI)?

Client-side ad insertion (CSAI) is a video ad-serving method whereby the video player requests an ad from an ad server via the video player located inside an application or website. When the ad server has received the ad request from the video player, it sends back an ad and displays it inside the video content.

With client-side ad insertion, it’s the client application and video player that are responsible for handling communication with the ad server. For example, the video player has to stop the video and make an API call to the ad server to request an ad. Once the ad has been displayed, the video player then resumes the video.

The actual advertisement that is displayed to users is selected based on the campaign’s criteria, which can include information relating to the user, publisher (e.g. website) and contents of the video.

The Main Advantages of Client-Side Ad Insertion

Here are just some of the main advantages of client-side ad insertion:

- It’s capable of supporting various kinds of ads, be it skippable, clickable, or closable.

- Tracking metrics for ad performance reporting is easy and very detailed, and provides a lot event data for ad-tracking services.

- Publishers and advertisers can use different ad formats, such as surveys, click-throughs, and overlays.

- It works with and without ad markers.

- Thanks to the advanced CSAI technology, it’s easy to offer highly personalized ads as data about the user and publisher can be used to determine which ad to display.

What Is Server-Side Ad Insertion (SSAI)?

Server-side ad insertion (SSAI) is a video ad-serving method whereby the ads are stitched directly into the video content on the server side instead of the client application or video player, as is the case with client-side ad insertion (CCAI).

It can be compared to traditional broadcast channel ad breaks as the transition from the video content to the ad break is smooth since the viewer isn’t waiting for the ad to load.

This makes it a continuous viewing experience with no pauses or breaks between the content and ads.

This method consists of various separate functionalities:

- Manifest manipulation — responsible for personalizing the video experience for every viewer.

- Ad server communication — used to communicate between the video server and ad server to deliver ads and collect data about the performance of the campaign, e.g. ad views.

- Ad bitrate with resolution normalization — bitrate is the number of bits of video information that is transmitted per second, either in kilobits/sec or megabits/sec.

Because SSAI is done on the server side, it works even for devices where inserting code might be difficult.

What’s crucial about this insertion method is that the client is not making calls to servers. Because of that, it’s harder to block ads inserted using SSAI.

The Main Advantages of Server-Side Ad Insertion

Here are some of the main advantages of server-side ad insertion:

- This ad insertion method is great for linear and live streams, or VOD, as the ad is stitched directly to the stream, making it less susceptible to ad-blocking software.

- Once the ads have been stitched into the video content, the video content and ads can then be used in an unlimited number of applications.

- Ads can be inserted over a linear slate, so no black screens.

- SDKs are not necessary thanks to codeless integration, so no regular code updates are required.

- SSAI offers high ad-fill rates and can generate more impressions, with the average completion rate for SSAI ads on live TV being 98%.

- Varying bandwidth conditions allow SSAI to effortlessly deliver a smooth playback experience, improving the streaming quality.

Now that we’ve talked about both CSAI and SSA, let’s compare these 2 ad insertion methods.

What’s the Difference Between Client-Side Ad Insertion and Server-Side Ad Insertion?

Ad Insertion

- With CSAI, ads are inserted into the video content via the video player.

- With SSAI, ads are stitched into the video content.

Ad Targeting

- Thanks to CSAI technology, a lot of highly personalized ads can be served,

- SSAI vendors are not that successful in that department, as they are met with massive drain on resources.

Measurement

- CSAI can offer rich tracking and metrics, as the process of setting up tracking is not complicated — VAST allows video players to report on video ad completion, clicks, click-throughs, etc.

- Believing an SSAI vendor that an ad was stitched into the stream doesn’t seem to be enough anymore, so there’s a demand for independent, client-side verification of this.

Viewer Experience

- When it comes to SSAI, communications for ad decisions and the actual ad stitching are performed by components upstream of client applications, providing a smooth playback experience.

- In CSAI, on the other hand, it’s done downstream by the video player and results in frame drop in video.

CSAI might have been more popular when it comes to streaming and over-the-top (OTT) ad delivery, but it has some challenges that are addressed by SSAI. That’s exactly why SSAI has been catching up to CSAI in the video-based ad monetization landscape and soon will become the superior option.

All in all, no matter which method you pick, both can provide ads that will be targeted and relevant to the viewer.

With that being said, they are way better than traditional broadcast channel ad slots, as you can never be completely sure who is watching and the audience data is most certainly not as precise.

We Can Help You Build a Connected TV (CTV) Ad Platform

Our AdTech development teams can work with you to design, build, and maintain a custom-built connected TV (CTV) ad platform for any programmatic advertising channel.

The post What’s the Difference Between CSAI and SSAI? appeared first on Clearcode.

]]>The post What Is a Meta-DSP and How Do You Build One? appeared first on Clearcode.

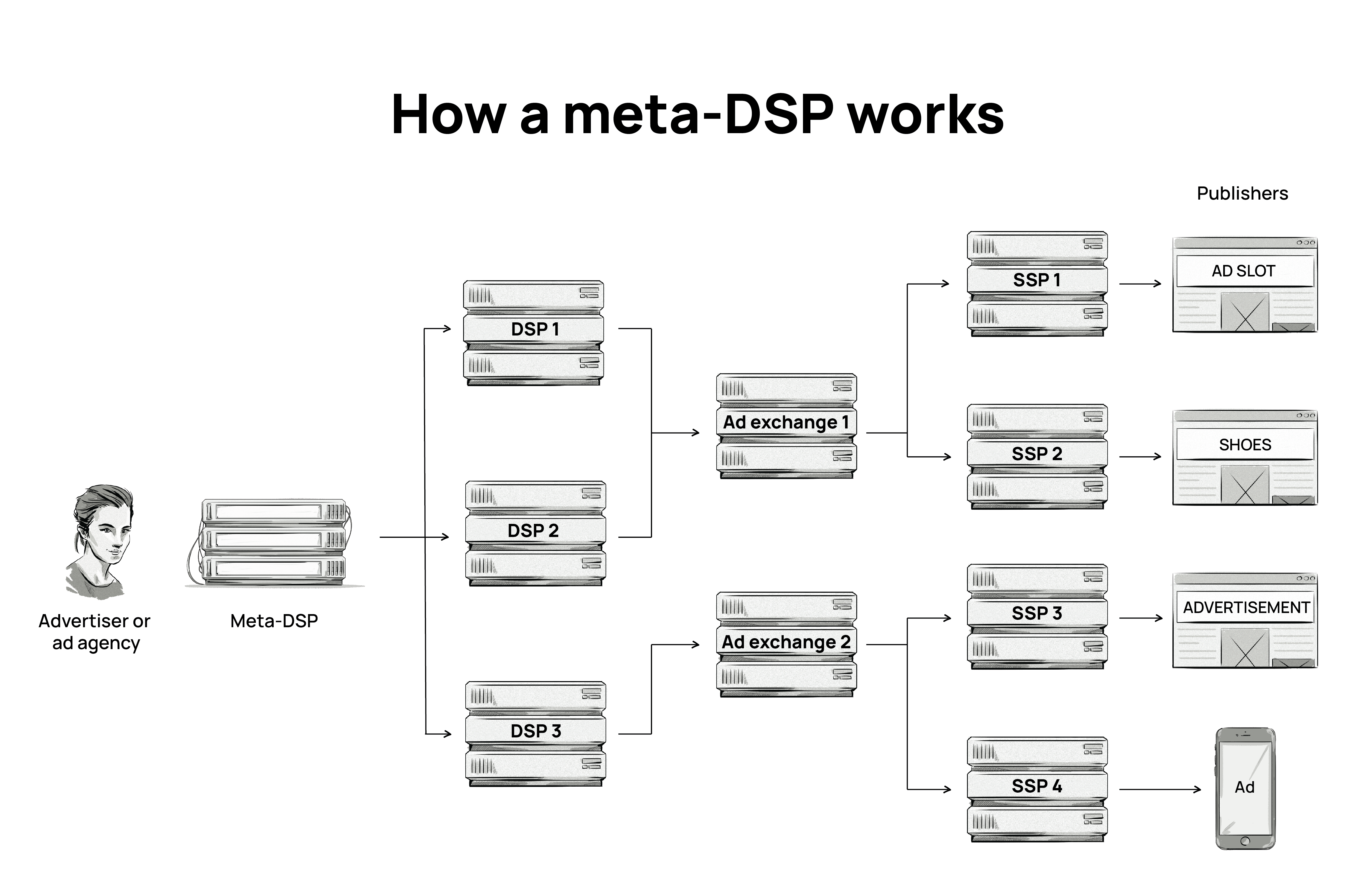

]]>On the buy side, the most common platform used by brands and ad agencies to purchase ad space is called a demand-side platform (DSP).

DSPs allow media buyers (i.e. brands and ad agencies) to purchase ad space on an impressions-by-impression basis via a process known as real-time bidding (RTB).

Over the years, many brands and ad agencies have started using more than one DSP to run campaigns. This has led to inefficiencies and time-consuming and redundant tasks.

In an effort to help brands and ad agencies solve these issues, a new type of platform has emerged — a meta-DSP.

In this blog post, we explain what a meta-DSP is, how it works, and how it differs from a regular DSP.

Key Points

- A meta-DSP is a piece of software that sits on top of existing DSPs.

- While a meta-DSP is classed as an AdTech platform, it’s not actually a demand-side platform (DSP). It’s rather a tool designed to centrally manage and automate campaign design, targeting, trafficking, and reporting across various DSPs.

- The role of a meta-DSP is to simply allow brands and ad agencies to create, set up, and manage multiple campaigns across various DSPs via one user interface

- To allow meta-DSPs to create, set up, and manage campaigns, they need to integrate with the various DSPs — typically via an API. If the meta-DSP utilizes data for ad targeting or reporting on campaign performance, then they’ll also need to integrate with data platforms and sources, such as a data lake and customer data platform (CDP).

- A regular DSP allows media buyers (advertisers and agencies) to run advertising campaigns and buy inventory from numerous ad exchanges and SSPs through one user interface. A meta-DSP, on the other hand, is a platform that essentially aggregates many DSPs in one place.

What Is a Meta-DSP?

A meta-DSP is a piece of software that sits on top of existing DSPs. While a meta-DSP is classed as an AdTech platform, it’s not actually a demand-side platform (DSP). Instead, a meta-DSP is a tool designed to centrally manage and automate campaign design, targeting, trafficking, and reporting across various DSPs.

Compared to your standard DSP, a meta-DSP doesn’t usually conduct media buying. The DSPs that connect to the meta-DSP are responsible for media buying via real-time bidding (RTB) auctions.

The role of a meta-DSP is to allow brands and ad agencies to create, set up, and manage multiple campaigns across various DSPs via one user interface.

A meta-DSP is responsible for analyzing the different targeting capabilities and inventory sources of the various DSPs it is connected to. Not only that, but they are also capable of choosing which DSP should be used to purchase a particular impression based on the campaign’s KPIs.

We Can Help You Build a Demand-Side Platform (DSP)

Our AdTech development teams can work with you to design, build, and maintain a custom-built demand-side platform (DSP) for any programmatic advertising channel.

How Do Meta-DPSs Work?

To allow meta-DSPs to create, set up, and manage campaigns, they need to integrate with the various DSPs — typically via an API. If the meta-DSP utilizes data for ad targeting or reporting on campaign performance, then they’ll also need to integrate with data platforms and sources, such as a data lake and customer data platform (CDP).

Once an advertiser has created a campaign in the meta-DSP, that information will then be passed on to the various DSPs it’s connected to. Data and metrics about the performance of the campaigns can also be sent back to the meta-DSP for creating and viewing reports.

What’s the Difference Between a DSP and a Meta-DSP?

A regular DSP allows media buyers (advertisers and agencies) to run advertising campaigns and buy inventory from numerous ad exchanges and SSPs through one user interface. DSPs play a crucial role in the real-time bidding (RTB) process, allowing advertisers to buy media on an impression-by-impression basis.

A meta-DSP, on the other hand, is a platform that essentially aggregates many DSPs in one place.

A meta-DSP should be distinguished from a regular DSP as it is an advanced trading and management platform responsible for unifying multiple DSPs and technologies through one single entry point that creates a holistic view of the media ecosystem.

Because a meta-DSP brings many different DSPs together, it gives marketers access to multiple and powerful media-buying tools from a single entry point. By managing multiple DSPs from one user interface, meta-DSPs provide advertisers and agencies with greater audience reach, unique customer data, and better insights into campaign performance.

One of the main reasons why brands and agencies use a meta-DSP is because it can be hard for them to find a DSP that has all the features and targeting capabilities they need.

For instance, DSP 1 might offer geo-fencing technology, DSP 2 might specialize in mobile advertising, and DSP 3 might only offer a certain type of ad format (e.g. text and image ads).

While many advertisers and agencies use different DSPs for different campaigns, by using a meta-DSP they can automate their workflows, increase efficiency and improve the performance of ad campaigns.

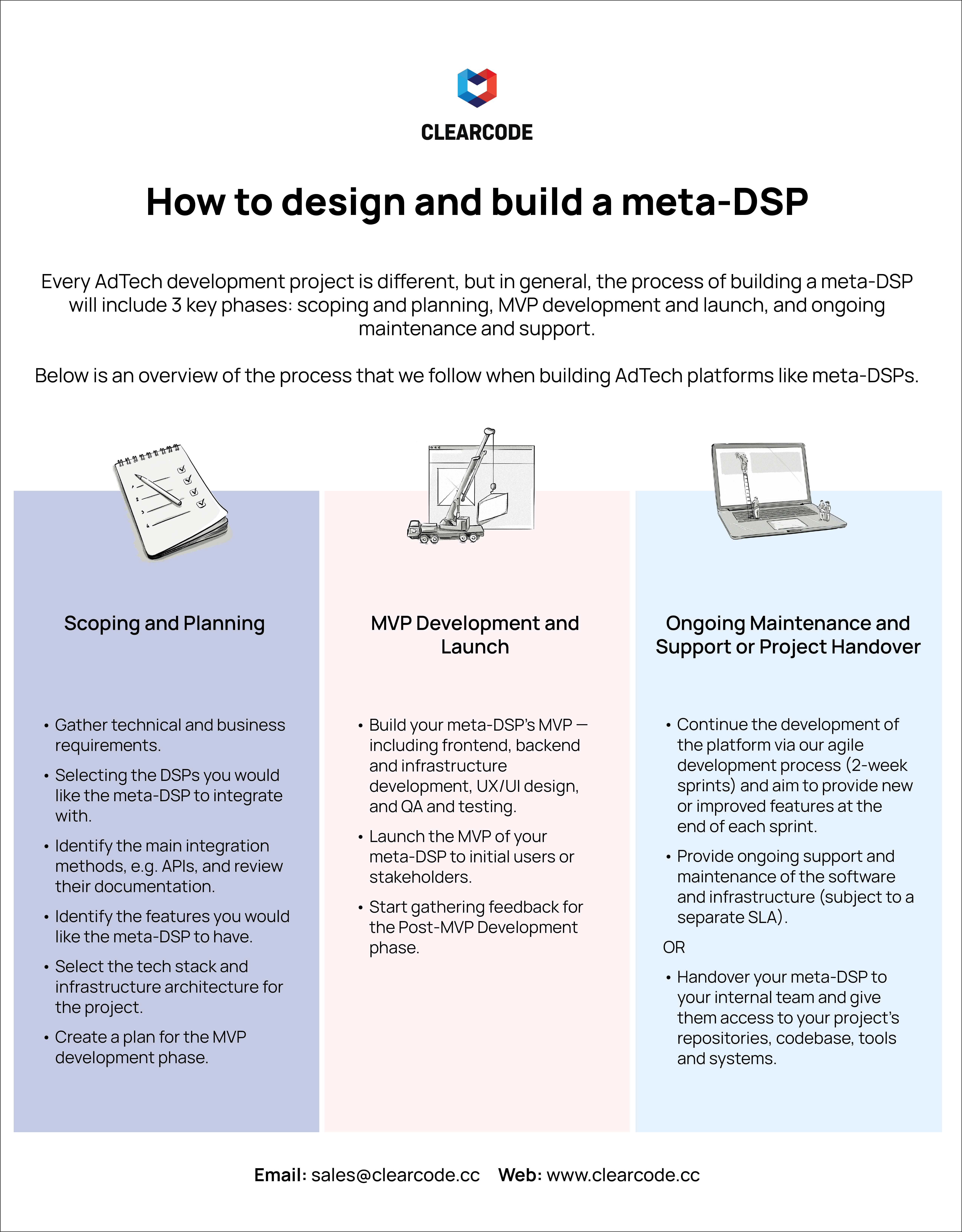

How Do You Build a Meta-DSP?

While there are many meta-DSPs on the market, many companies, especially ad agencies and AdTech companies, can benefit from building their own meta-DSP.

When we’re talking about “building a meta-DSP”, we’re referring to a custom software development project whereby you design and build your own proprietary meta-DSP.

How to Design and Build a Meta-DSP

View the image below to learn more about how we build AdTech platforms like meta-DSPs.

We Can Help You Build a Demand-Side Platform (DSP)

Our AdTech development teams can work with you to design, build, and maintain a custom-built demand-side platform (DSP) for any programmatic advertising channel.

The post What Is a Meta-DSP and How Do You Build One? appeared first on Clearcode.

]]>